After nearly five years, the Reserve Bank of India (RBI) has finally decided to cut interest rates. In its latest Monetary Policy Committee (MPC) meeting, the central bank reduced the repo rate by 25 basis points, bringing it down from 6.5% to 6.25%. This decision was taken by all six MPC members.

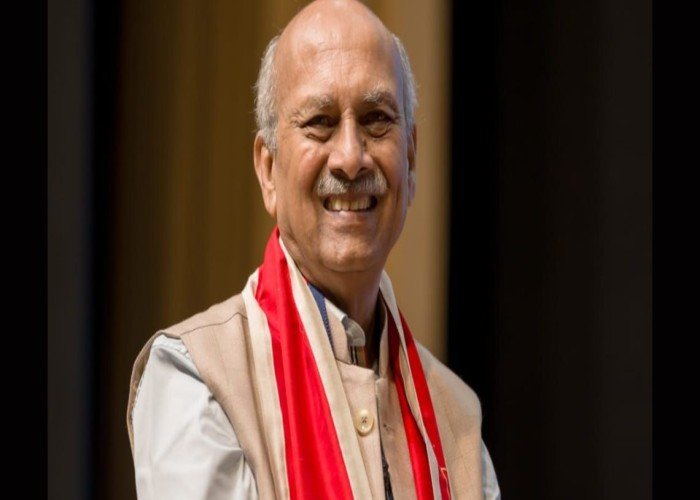

RBI Governor Sanjay Malhotra, who chaired his first MPC meeting, announced the rate cut. The last time RBI reduced the repo rate was in May 2020, but since May 2022, rates have been increasing due to inflation concerns.

How Will This Affect Your EMI?

With this rate cut, home loan, auto loan, and personal loan borrowers could get some relief. If banks pass on this benefit to customers, monthly EMIs may decrease. However, the actual impact will depend on how individual banks adjust their lending rates.

Inflation and Growth Projections

Governor Malhotra stated that RBI is working towards strengthening the economy, which is currently stable. Inflation targeting has shown positive results, and the central bank will continue supporting economic growth.

For the financial year 2025, retail inflation is expected to be around 4.8%. The manufacturing sector has shown early signs of recovery, and while urban demand remains mixed, rural demand is improving.

RBI has projected real GDP growth for 2025-26 at 6.75%. Growth estimates for different quarters are; April-June 2025: 6.7%, July-September 2025: 7%, and October-March 2026: 6.5%

The real estate sector has welcomed this decision. Industry experts believe that lower interest rates will make home loans cheaper, making buying houses easier. Developers will also benefit as financing will become more affordable, helping them complete projects faster.

Sunny Bijlani, Joint Managing Director of Supreme Universal, and Manju Yagnik, Senior Vice President of NAREDCO Maharashtra, called the move beneficial for both homebuyers and developers. Lower EMIs will make property purchases more affordable, while improved funding options will boost construction and bring new energy to the real estate market.

This repo rate cut is a positive step that could ease financial burdens for borrowers and boost economic growth. Now, all eyes are on banks to see if they pass on these benefits to customers.