The Maharashtra State Cooperative (MSC) Bank has made history by reporting its highest-ever business turnover of ₹61,956 crore for the financial year ending March 31, 2025. Along with this, the bank earned a record net profit of ₹651 crore—marking its fourth straight year of consistent growth.

With this achievement, the bank’s total net worth has risen to ₹5,300 crore, making MSC Bank the first cooperative bank in India to cross the ₹5,000 crore net worth milestone.

Steady Growth Over the Years

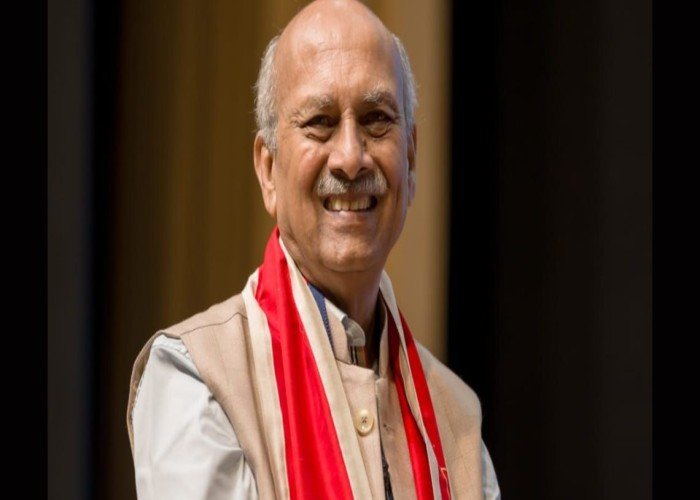

According to MSC Bank’s Administrative Board Chairman Vidyadhar Anaskar, the bank has shown a steady rise in profit over the years. In FY 2022 the bank made a profit of ₹603 crore, ₹609 crore in FY 2023, ₹615 crore in FY 2024 and ₹651 crore in FY 2025.

For FY 2025, the gross profit stood at ₹1,032 crore. Deposits reached ₹26,359 crore and total loans (advances) increased to ₹35,597 crore. The bank’s total owned funds have also gone up to ₹7,737 crore.

RBI Approves Bond Issue

Based on its strong financial position, the Reserve Bank of India has allowed MSC Bank to raise ₹500 crore through Perpetual Debt Instruments (PDI). This will help the bank further strengthen its capital and support future growth.

Supporting Other Cooperative Banks

MSC Bank is also helping other struggling cooperative banks in Maharashtra. It is currently acting as the Institutional Administrator for Nagpur District Central Cooperative Bank as well as Institutional Advisor for Nashik District Central Cooperative Bank. MSC has also made a ₹300 crore low-interest loan to Buldhana District Central Cooperative Bank.

Tech-Driven and Farmer-Focused

MSC Bank is leading the way in technology and security. It has launched India’s first Cyber Security Operation Center (C-SOC) among state cooperative banks, located in Vashi, Navi Mumbai. The bank has also earned the ISO 27001:2013 certification for its high security standards in data handling.

In an innovative move to support farmers, the bank partnered with the Maharashtra State Warehousing Corporation to offer loans against warehouse receipts using blockchain technology. Under this scheme, loans worth ₹205 crore have already been disbursed, helping farmers get easy and timely access to credit.

With record-breaking financial results, tech upgrades, and efforts to support rural banking, MSC Bank is setting new standards in the cooperative banking sector across India.